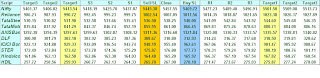

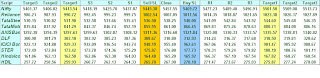

Reliance:Below 1025 weaken him;

One can buy @ 1003 levels with sl 998 (only 5rs risk) - tgt 1025 (Risky call)

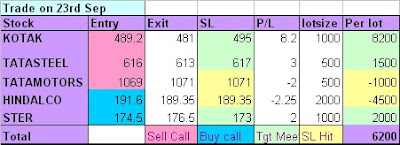

TataSteel:Last week Close: 537 / last two days lows are 537.10 /537.05

Close below 532 will be worry for bulls;

Buy around 532 - 537 levels with SL 527 (537 if not broken in Intra, then it will get ready for further rally above 543)

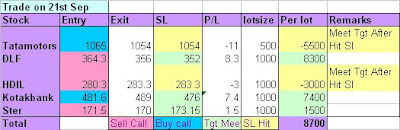

Tatamotors:He took exact support @ 836 (835 Yesterday low) and closed above 856 signals his further rally;

One can buy again around 856 for tgt of 890

AxisBank:Weaken of Week: Lower side may test 1280 Keep sl @ 1329 for your positional Short.

Sell around 1323 range with Sl 1332

DLF:Last 5 days ascending lows ( 300 -302.15 - 304 - 305.60 - 310):

Closed above 307 shows some interest in Bulls:

close above 307 will take him 327 (*Last twos days flash take him consider)

ICICIBank:If opens below 961 sell with sl 969 tgts 953 - 946

Ster:Below 175 will be worry for Bulls; (174.85 las week low)

But one can add in portfolio @ 175 level for tgt of 185

Hindalco:Last 9 days forms ascending Lows;

Hold this stock; 162 will be right place to add him in portfolio

HDIL:

SAR @ 263;

Nifty Spot:Close above 5460 will be sign for bull run; Before strong close we can expect small correction or stagnant with HIM

NF SAR @ 5410Intraday levels: